Private health insurance is a crucial aspect of healthcare in Australia. It provides individuals with access to medical services and treatments that are not fully covered by the public healthcare system. With the out-of-pocket cost of healthcare, having private health insurance can be a significant financial burden. Understanding the costs involved is essential for making informed decisions about your healthcare.

In this article, we will explore the costs of private health insurance in Australia for 2024. We will discuss the factors that affect the cost, the different types of policies available, and the average monthly premiums for individuals and families. By understanding the costs, you can make a more informed decision about whether private health insurance is right for you and your family.

How Much Does Private Health Insurance Cost Per Month in Australia in 2024?

In 2024, the average cost of private health insurance in Australia is around $160 per month for a single person, or $1,920 per year. This is based on the approved 3.03% average annual increase in health insurance premiums that took effect on April 1, 2024.

For those under 36, the average annual cost of combined hospital and extras health insurance for singles is $3,017, which is about $251 per month. For singles aged 36 to 59, the average annual cost is $3,456, or around $288 per month. And for those aged 60 and over, the average annual cost is $3,829, which is approximately $319 per month.

The average annual cost of hospital-only health insurance for singles under 36 is $2,257, or about $188 per month. For people aged 36 to 59, it’s $2,713 annually, or around $226 per month. And for those aged 60 and over, the average annual cost is $3,076, which is approximately $256 per month.

For extras-only health insurance, the average annual cost for singles is $877 for lower levels of coverage, which is about $73 per month. For mid-level coverage, it’s $1,046 annually, or around $87 per month. And for higher levels of coverage, the average annual cost is $1,157, which is approximately $96 per month.

It’s important to note that these are just averages, and the actual cost of private health insurance can vary depending on factors such as the level of coverage, the insurer, and the individual’s age and health status. Additionally, the private health insurance rebate provided by the Australian government can help reduce the cost of premiums for eligible individuals.

What is Health Insurance?

Health insurance is a type of protection that helps pay for medical expenses when you get sick or hurt. It is like having a safety net that ensures you can get the care you need without worrying about the cost. When you have health insurance, you pay a small amount of money each month, called a premium, and in return, the insurance company agrees to cover a portion of your medical bills.

Health insurance covers a wide range of medical services, including doctor visits, hospital stays, surgeries, and prescription medications. It can also provide additional benefits, such as mental health services, vision care, and dental care. Having health insurance can give you peace of mind, knowing that you are prepared for any unexpected medical expenses that may arise.

There are different types of health insurance plans, each with its own set of benefits and costs. Some plans may have lower premiums but higher deductibles, while others may have higher premiums but lower deductibles. It is important to carefully consider your options and choose a plan that best fits your needs and budget.

In addition to individual plans, many employers offer health insurance as a benefit to their employees. These group plans often have lower premiums and more comprehensive coverage than individual plans. Some employers may also offer additional benefits, such as flexible spending accounts or health reimbursement arrangements.

Who Are Health Insurers?

Health insurers are typically private health insurers that offer health insurance products to individuals and families. These insurers may also be referred to as a health insurance provider or health fund. These private health insurers offer a range of health insurance plans to cover various medical expenses such as hospital stays, medical procedures, prescription drugs, and preventive care. Individuals can choose from different levels of coverage depending on their needs and budget.

Health insurers negotiate contracts with healthcare providers and hospitals to establish a network of preferred providers for their policyholders. This network helps to lower healthcare costs for policyholders and ensures that they receive quality care.

In addition to individual and family health insurance plans, health insurers also offer group health insurance plans to employers. These plans are typically offered as part of an employee benefits package and provide coverage for a group of employees and their dependents.

The Different Tiers of Health Insurance in Australia

The most basic tier of health insurance is known as “hospital cover.” This type of insurance provides coverage for hospital stays, surgeries, and other medical procedures. It usually includes a range of benefits, such as access to private hospitals, specialist consultations, and medical tests. Hospital cover is often the most affordable option for individuals who do not require extensive medical care.

The next tier of health insurance is known as “extras cover.” This type of insurance provides coverage for additional medical services beyond what is included in hospital cover. Extras cover typically includes benefits such as dental care, optical care, and physiotherapy. It is often chosen by individuals who require regular medical services, such as dental check-ups or eye exams.

The highest tier of health insurance is known as “combined cover.” This type of insurance combines hospital cover and extras cover, providing comprehensive coverage for all medical services. Combined cover is often chosen by individuals who require extensive medical care or have a high level of medical needs.

Factors That Affect the Cost of Health Insurance in Australia

When it comes to health insurance in Australia, the cost can vary significantly from one person to another. There are several factors that contribute to these differences, making it essential to understand what affects the cost of health insurance. In this article, we will explore the key factors that influence the cost of health insurance in Australia.

One of the primary factors that affect the cost of health insurance is age. As people get older, their health insurance premiums tend to increase. This is because older individuals are more likely to require medical attention, which increases the risk for insurance providers. For example, a 25-year-old may pay around $50 per month for basic health insurance, while a 55-year-old may pay around $150 per month for the same coverage.

Another significant factor that affects the cost of health insurance is the level of coverage chosen. Health insurance policies in Australia offer varying levels of coverage, ranging from basic to comprehensive. Basic policies typically cover only essential medical services, while comprehensive policies cover a broader range of services, including dental, optical, and physiotherapy. The more comprehensive the policy, the higher the premium. For instance, a basic policy may cost around $50 per month, while a comprehensive policy may cost around $200 per month.

The type of health insurance policy also plays a crucial role in determining the cost. There are several types of policies available, including hospital-only, extras-only, and combined policies. Hospital-only policies cover hospital stays and surgical procedures, while extras-only policies cover services such as dental, optical, and physiotherapy. Combined policies offer a mix of both hospital and extras coverage. The cost of these policies varies depending on the level of coverage and the provider.

Finally, the provider of the health insurance policy can also impact the cost. Different insurance providers offer varying levels of coverage and pricing. Some providers may offer more comprehensive coverage at a higher cost, while others may offer basic coverage at a lower cost. It is essential to research and compare different providers to find the best option for your needs and budget.

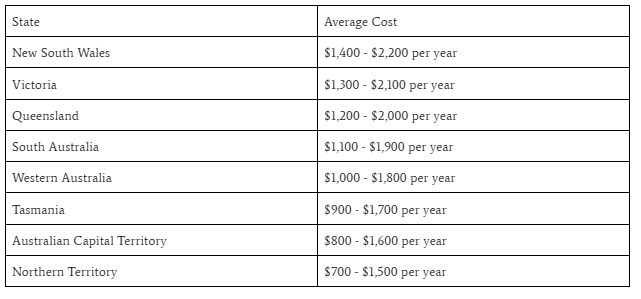

Average Cost of Hospital Cover in Each Australian State

The cost of hospital cover in Australia varies significantly from state to state. This is due to differences in healthcare systems, insurance providers, and the level of coverage offered. Understanding these costs is crucial for individuals and families to make informed decisions about their healthcare insurance.

The average cost of hospital cover in each Australian state is outlined below:

As shown in the table, the average cost of hospital cover in New South Wales is the highest, ranging from $1,400 to $2,200 per year. In contrast, the Northern Territory has the lowest average cost, ranging from $700 to $1,500 per year. These differences are largely due to variations in healthcare systems and insurance providers across the states.

When choosing a hospital cover, it is essential to consider the level of coverage and the cost. Some policies may offer more comprehensive coverage, but at a higher premium. Others may offer more basic coverage at a lower cost. It is crucial to carefully review the policy details and consider individual needs before making a decision.

What Does Hospital-Only Cover Cost?

One type of coverage is called hospital-only insurance. This type of insurance specifically covers medical expenses related to hospital stays and surgeries. It does not cover other types of medical expenses, such as doctor visits or prescription medications.

So, what does hospital-only insurance cost? The cost of hospital-only insurance can vary depending on several factors, including your age, health, and the insurance provider. Generally, hospital-only insurance is less expensive than comprehensive health insurance that covers a wider range of medical expenses. This is because hospital-only insurance only covers a limited set of medical expenses.

On average, hospital-only insurance can cost anywhere from $50 to $200 per month for an individual. For a family, the cost can range from $100 to $400 per month. These costs are typically lower than those of comprehensive health insurance, which can range from $200 to $1,000 per month or more for an individual, and $500 to $2,000 per month or more for a family.

It’s important to note that hospital-only insurance may not be the best option for everyone. If you have ongoing medical needs or require regular doctor visits, comprehensive health insurance may be a better choice. However, if you are generally healthy and only need coverage for hospital stays and surgeries, hospital-only insurance could be a more affordable option.

Is Private Health Insurance Worth It?

When it comes to healthcare, many people wonder if private health insurance is worth the cost. This is a valid concern, especially considering the high premiums and deductibles associated with these policies. However, there are several benefits to having private health insurance that make it a worthwhile investment for many individuals.

One of the primary advantages of private health insurance is the ability to choose your own healthcare provider. This means you can select a doctor or hospital that you trust and feel comfortable with, which can lead to better health outcomes. Additionally, private health insurance often provides access to specialised care and treatments that may not be available through government-funded programs. This can be especially important for individuals with chronic conditions or those who require ongoing medical treatment.

Another significant benefit of private health insurance is the financial protection it offers. With a private policy, you are less likely to face significant medical bills or debt if you need to undergo a costly procedure or treatment. This can be a significant stress relief and provide peace of mind, especially during times of financial uncertainty. Furthermore, many private health insurance policies offer additional benefits, such as dental and vision coverage, which can help to further reduce out-of-pocket expenses.

Ultimately, whether or not private health insurance is worth it depends on your individual circumstances and priorities. If you value the flexibility to choose your own healthcare provider and the financial protection that comes with private insurance, it may be a worthwhile investment for you.

However, if you are on a tight budget or have access to affordable healthcare through other means, you may not need to invest in private insurance. It is essential to weigh the costs and benefits carefully before making a decision.

How Health Insurance Premiums Work

Health insurance premiums are the monthly payments you make to have health insurance. These premiums are usually paid to an insurance company, which then provides you with coverage for medical expenses. Think of it like a safety net that helps you pay for unexpected doctor visits, hospital stays, or prescription medications.

When you buy health insurance, you agree to pay a certain amount of money each month, known as the premium. This premium is usually based on factors such as your age, health, and the type of insurance plan you choose. The more comprehensive the plan, the higher the premium. For example, a plan that covers more doctor visits and hospital stays might cost more than a basic plan that only covers emergencies.

The insurance company uses the premiums it collects to pay for medical expenses when you need care. This is why it’s essential to choose a plan that fits your budget and meets your health needs. If you don’t pay your premiums on time, you might lose your coverage, which means you’ll have to pay for medical expenses out of pocket. This can be very costly and stressful, so it’s crucial to stay on top of your payments.

To make health insurance premiums more affordable, many insurance companies offer discounts for things like being part of a group plan (like an employer-sponsored plan), being a non-smoker, or having a good health history. You can also shop around to compare prices and find a plan that fits your budget. By understanding how health insurance premiums work, you can make informed decisions about your health care and stay protected from unexpected medical expenses.

Conclusion

In Australia, the cost of private health insurance can vary significantly depending on several factors such as age, health, and the type of insurance plan chosen. While it may seem daunting to navigate the complex world of health insurance, understanding the costs involved can help you make informed decisions about your health care. Here, we’ve broken down the costs of private health insurance in Australia to give you a better idea of what to expect.

Ultimately, the cost of private health insurance in Australia will depend on your individual circumstances. However, by considering your health needs, budget, and the level of coverage you require, you can find a plan that suits your lifestyle. Remember to shop around, compare prices, and take advantage of discounts to get the best value for your money. With the right health insurance plan, you can enjoy peace of mind knowing that you’re protected from unexpected medical expenses.

FAQ's

A: In 2024, the average cost of private health insurance in Australia is around $160 per month for a single person, or $1,920 per year. This is based on the approved 3.03% average annual increase in health insurance premiums that took effect on April 1, 2024.

A: Pocket costs refer to the out-of-pocket expenses that you may need to pay when using private health insurance services, such as co-payments, deductibles, and coinsurance. These costs can vary depending on your level of coverage and the specific medical services you use.

A: Private health insurance generally offers more comprehensive coverage and shorter wait times compared to public healthcare. However, it comes at a higher cost. The average cost of private health insurance is higher than the cost of relying solely on public healthcare services.

A: To reduce the cost of private health insurance, you can consider options such as choosing a higher deductible, opting for a more limited coverage plan, comparing quotes from different health insurance companies, and taking advantage of any discounts or incentives offered by insurers.

A: To compare different health insurance plans, you can consider factors such as the cost of premiums, deductibles, copayments, coverage limits, network of healthcare providers, and any additional benefits offered. You can use online comparison tools or consult with insurance brokers for assistance.

A: The best health insurance company for you will depend on your individual health needs, budget, and preferences. Some popular health insurance companies in Australia include Medibank, Bupa, HCF, and NIB. It’s recommended to compare quotes and policies from multiple insurers to find the best fit for you.

A: Private health insurance cover approved by The Department of Health in Australia includes hospital insurance and extras cover. The average monthly cost of health insurance can vary depending on the level of cover and the provider. When buying private health insurance, it is important to compare health insurance policies to find the best value for your needs.

Lifetime health cover loading may apply if you do not take out private health insurance before the age of 31. The cost of your health insurance will also depend on factors such as your age, location, and health status. Private health insurance can help cover medical costs and health care services not covered by Medicare.