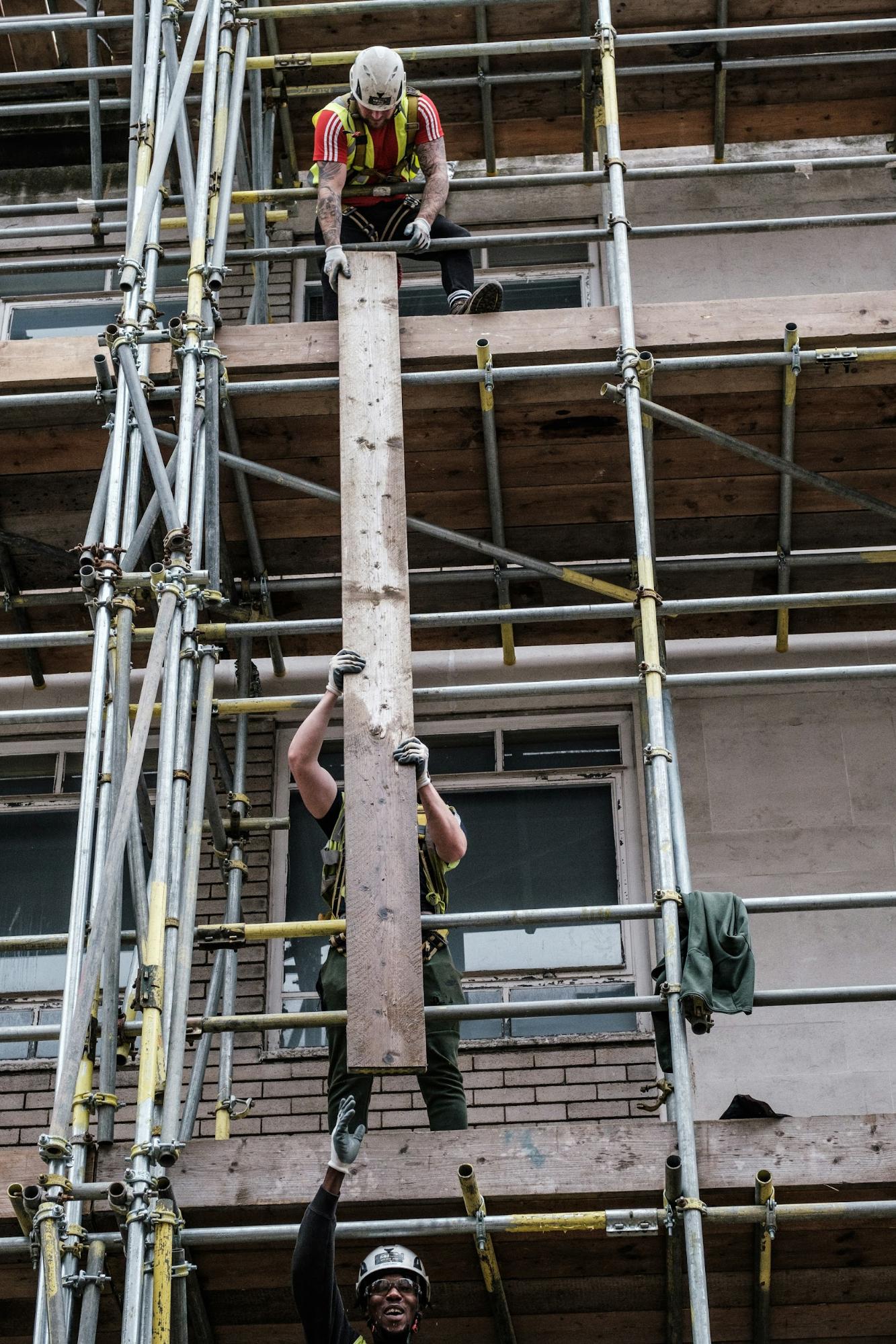

Running a scaffolding business comes with its fair share of risks and challenges. From working at great heights to handling heavy equipment, scaffolders and contractors face potential hazards every day. To safeguard your business against unforeseen circumstances, having the right insurance coverage is crucial. In this article, we will delve into the importance of public liability insurance for scaffolders and contractors, different types of insurance coverage available, considerations for choosing the right insurance, and expert advice on protecting your tools and equipment.

What is Public Liability Insurance and Why is it Important for Scaffolders?

Public liability insurance is a type of insurance that provides coverage for claims made against your business for property damage or personal injury to third parties. For scaffolders and contractors, this insurance is particularly vital due to the nature of the work involved. The risks of accidents or property damage are inherent in the scaffolding industry, making public liability insurance a necessity.

Public liability insurance covers the legal costs and compensation payments if a third party sues your business for injury or property damage caused by your work.

Having public liability insurance provides financial protection and peace of mind in case of unexpected accidents or incidents that could potentially lead to costly legal claims against your business.

Public liability insurance typically covers risks such as accidental damage to property, personal injury to third parties, and legal expenses associated with defending a claim made against your business.

Types of Insurance Coverage Available for Scaffolding Businesses

When it comes to insurance coverage for scaffolding businesses, there are various options to consider. Understanding the differences between public liability insurance and scaffold insurance is essential to choose the right coverage that suits your business needs.

While public liability insurance covers claims from third parties for property damage or injury, scaffold insurance specifically focuses on risks associated with scaffold work, such as collapse or damage to the structure.

Scaffolder insurance policies are tailored to the unique risks faced by scaffolders, providing coverage for accidents, injuries, and damage that may occur during scaffold installation or dismantling.

Aside from public liability and scaffold insurance, scaffolders can also benefit from additional business insurance options such as income protection, workers’ compensation, and property damage coverage.

Factors Affecting Scaffold Insurance

One of the primary factors is the type of scaffolding being used. Different types of scaffolding, such as mobile scaffolding or suspended scaffolding, have different levels of risk associated with them. For example, mobile scaffolding is generally considered to be less risky than suspended scaffolding, which can be more prone to accidents. As a result, the cost of insurance for suspended scaffolding is typically higher.

Another important factor is the location where the scaffolding is being used. Scaffolding used in areas with high winds, extreme temperatures, or other hazardous conditions can be more expensive to insure. Additionally, scaffolding used in areas with a higher risk of theft or vandalism may also require additional coverage. These factors can significantly impact the cost of scaffold insurance and the availability of coverage.

Finally, the experience and reputation of the scaffolding company can also affect the cost and availability of insurance. Companies with a good safety record and a history of following safety protocols are generally viewed as lower-risk and may be able to secure better insurance rates. On the other hand, companies with a history of accidents or safety violations may face higher insurance costs or even be unable to secure coverage.

What Sort of Claims Do Scaffolders Have?

Common claims made by scaffolders include those related to falls from heights, which can result in serious injuries or even death. They may also claim for injuries caused by heavy objects falling on them or being struck by moving equipment. Additionally, scaffolders can develop musculoskeletal disorders from repetitive strain or heavy lifting, leading to claims for compensation.

Scaffolders may also claim work-related stress, which can be caused by factors such as tight deadlines, inadequate training, or poor working conditions. These claims are often more complex and require detailed documentation of the stressors and their impact on the worker’s mental health.

How to Choose the Right Insurance for Your Scaffolding Company

Choosing the right insurance for your scaffolding company involves evaluating various factors to ensure adequate coverage and protection against risks. Working with an experienced insurance broker can help you navigate the complexities of insurance policies and find the best solutions for your business.

Factors to Consider When Selecting Insurance for Scaffolders

Factors such as the size of your scaffolding business, the scope of projects you undertake, and the number of employees you have are crucial considerations when selecting insurance coverage.

Comparing Insurance Options for Scaffolding Businesses

Comparing insurance options allows you to assess the coverage limits, exclusions, premiums, and additional benefits offered by different insurers to make an informed decision that aligns with your business requirements.

Tips for Finding the Best Insurance Broker for Your Scaffolding Business

When seeking insurance for your scaffolding business, partnering with a reliable insurance broker who specialises in construction-related coverage can ease the process of finding the right insurance policies and negotiating suitable terms and premiums.

Protecting Tools and Equipment: Importance of Equipment Insurance for Scaffolders

Tools and equipment are essential assets for scaffolders, and protecting them against damage or theft is crucial for the continuity of your business operations. Including equipment insurance in your coverage can safeguard your valuable assets.

Equipment insurance policies cover the cost of repair or replacement of tools and equipment that are lost, stolen, or damaged due to unforeseen events, ensuring minimal disruption to your work.

Types of Property Damage Covered by Equipment Insurance

Equipment insurance typically covers property damage caused by factors such as fire, flood, theft, vandalism, or accidents, allowing you to recover the value of your tools and equipment.

Benefits of Including Equipment Insurance in Your Coverage

By including equipment insurance in your overall coverage, you can mitigate the financial impact of unexpected events that could otherwise jeopardise the smooth operation of your scaffolding business.

Expert Advice on Public Liability Insurance for Scaffolders and Contractors

Seeking expert advice on insurance matters can provide valuable insights into the intricacies of different insurance products and help you make informed decisions to protect your business and assets.

While public liability insurance covers claims from third parties for property damage or injury, workers’ compensation insurance compensates employees for work-related injuries or illnesses sustained during the course of employment.

General Advice for Scaffolding Businesses in Selecting Suitable Insurance Cover

For scaffolding businesses, it is essential to assess the specific risks associated with your line of work and tailor your insurance coverage to address those risks effectively, ensuring comprehensive protection.

Income protection insurance can provide financial support if you are unable to work due to injury or illness, while liability insurance protects your business from legal claims and liabilities, offering a well-rounded protection strategy for your scaffolding business.

FAQ's

Scaffolding public liability insurance is a type of insurance that provides coverage for claims made by contractors, sub-contractors, or the general public for damages or injuries that occur during scaffolding operations. It is crucial for the scaffolding industry to have this insurance in place to protect against the risks associated with their work.

Scaffolders and contractors in the industry may have various insurance needs, including workers compensation, liability insurance for scaffolding, and tailored insurance policies to cover risks unique to their operations.

Scaffolders liability insurance is designed to specifically protect scaffolders and contractors against claims or legal actions related to their work. Having this insurance can provide financial protection in case a claim is made against them.

Public liability insurance for scaffolding helps protect a scaffolding business by providing coverage for any claims made by contractors or the public for damages or injuries caused during scaffolding operations. It ensures that the business is financially protected in such situations.

Insurance experts can help scaffolders and contractors understand their insurance needs, assess the risks involved in their work, and choose the right insurance policies to protect their business and assets. Their expertise can be invaluable in ensuring adequate coverage.

Having authorised insurance means that the insurance policies meet the necessary regulatory requirements and are valid and reliable. It is crucial for scaffolders and contractors to have authorised insurance in place to ensure they are covered in case of any incidents or claims.

Scaffolders and contractors can ensure they have the right insurance in place for their risky business by working with insurance experts to assess their needs, understand the types of coverage available, and tailor insurance policies to match the specific risks associated with their work.