Strata insurance is a vital aspect of property ownership within a strata scheme in New South Wales (NSW). It serves to protect owners and the strata community against potential risks and liabilities. Let’s delve deeper into the specifics of strata insurance cover in NSW.

What is Strata Insurance and How Does It Work?

Strata insurance, as defined, is a type of insurance that covers common property within a strata scheme. It plays a crucial role in safeguarding the interests of owners and occupants in NSW buildings governed by strata laws. Key features of strata insurance cover include protection against damage to common areas, structural elements, and public liability cases.

What Does Strata Insurance Cover in NSW?

Strata insurance in NSW is designed to protect the owners corporation of a strata title property. Strata building insurance covers common or shared property within a strata scheme, such as the building itself, common areas, and shared facilities. This type of insurance also covers the body corporate’s legal liability and provides insurance to cover the cost of rebuilding or repairing damaged property.

In addition to physical damage, residential strata insurance may also cover loss of rent and temporary accommodation costs for residents if the property becomes uninhabitable. It is important for owners corporations to read the relevant product disclosure statement, as this document outlines the policy limits, exclusions, and any conditions that may apply. It is also essential to consider whether the insurance policy is appropriate for the specific needs of the strata scheme.

Strata insurance in NSW is typically provided by insurance companies. The insurance protects the owners corporation from financial loss due to damage or liability claims. However, it is important to note that strata insurance policies are prepared without taking into account the individual circumstances of each owner within the strata scheme.

Owners may need to arrange their own insurance to cover contents, fixtures, fittings, and any improvements made to their individual lots. Before purchasing strata insurance, owners should carefully consider whether the policy meets their needs and consult the relevant product disclosure statement and financial services guide for detailed information on the coverage provided.

What Strata Insurance Doesn’t Cover?

Strata insurance may provide cover for a range of risks associated with owning a residential strata property, but there are limitations to what it will cover. Strata insurance usually covers the building and common property as defined in the Strata Schemes Management Act 2015, but it may not cover certain items such as home contents or personal belongings.

It also may not provide cover for certain types of damage or events, such as certain kinds of water damage or certain acts of vandalism. Insurance brokers should carefully review the product disclosure statement provided by the insurer to understand what is covered and what is not.

Additionally, strata insurance may not provide public liability insurance to protect against claims made against the strata owner or strata committee for injury or damage on the property. It is important to consider whether additional insurance, such as public liability insurance or home insurance, is necessary to cover these risks. Strata insurance may also not cover the cost of certain types of maintenance or repairs that are the responsibility of the strata owner or strata committee.

Do Owners Corporation Need to Take Out Strata Insurance?

Owners corporations in NSW must take out strata insurance to safeguard the value of their assets and protect themselves from potential liabilities. Legal requirements mandate the presence of strata insurance for owners corporations in NSW, emphasising the importance of comprehensive coverage. The benefits of having strata insurance include financial security, peace of mind, and protection against legal claims.

What Types of Property Can Get Strata Insurance?

Strata insurance is particularly important for properties that are divided into separate units, such as apartments, townhouses, or condominiums. The insurance policy covers the building itself, as well as the common areas that are shared by all the owners, such as hallways, elevators, and parking lots.

Strata insurance can be purchased for various types of properties, including residential and commercial buildings. For example, it can be used to cover apartment complexes, office buildings, shopping centres, and even industrial facilities. The insurance policy typically includes coverage for damage to the building, as well as liability for injuries or damage to others. This type of insurance is essential for property owners who want to protect their investments and ensure that they are financially prepared for any unexpected events or disasters.

Who Manages Strata Insurance Policies in NSW?

Strata managers play a crucial role in handling insurance matters within strata buildings in NSW. Their responsibilities include obtaining quotes, managing claims, and ensuring compliance with insurance policies. Choosing the right strata manager for insurance needs involves evaluating their experience, expertise, and track record in dealing with insurance providers.

What Types of Insurance Are Available for NSW Strata Buildings?

Building insurance and strata insurance cover differ in their scope, with building insurance focusing on structural elements and strata insurance encompassing common areas and liabilities. Landlord insurance options cater to strata property owners in NSW, offering additional protection against tenancy-related risks. Considerations for selecting insurance vary based on the type of property and associated risks.

What is Contents Insurance and What Does it Cover?

Contents insurance is a type of insurance that helps protect your belongings from damage, theft, or loss. It covers items such as furniture, clothing, electronics, and other personal possessions inside your home. When determining if this insurance is right for you, it’s important to consider whether it is appropriate for your target market.

Contents insurance is especially important for those who live in strata properties in NSW. While the building itself is often covered by strata insurance, your personal belongings are not. Strata insurance also provides protection for common areas and shared assets within the strata community.

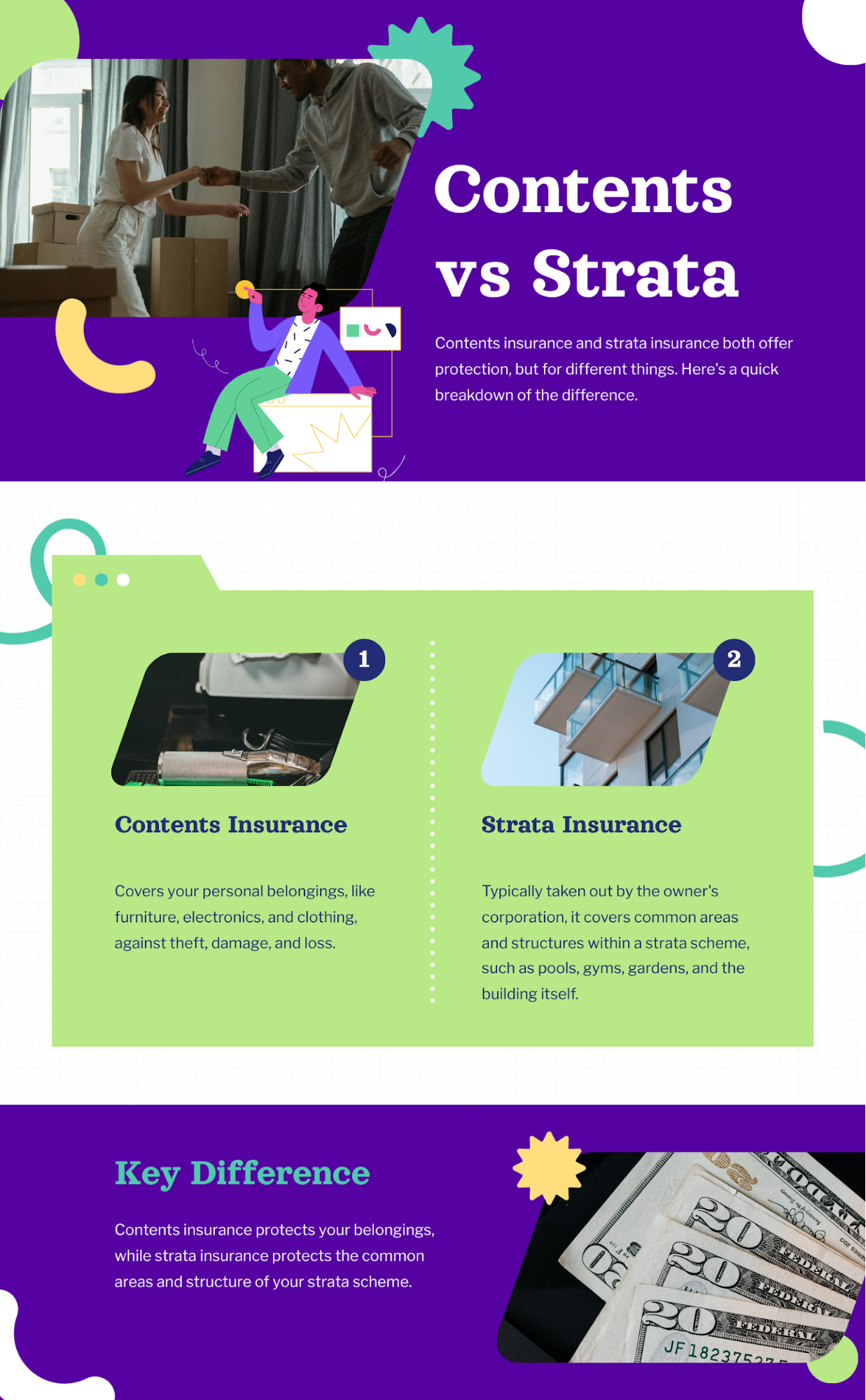

What is the Difference Between Contents Insurance and Strata Insurance?

The key difference between contents insurance and strata insurance is what they cover. Contents insurance focuses on the personal items within your home, while strata insurance covers the building itself.

Contents insurance typically covers your personal belongings, such as furniture, electronics, clothing, and other valuable items, in the event they are damaged, stolen, or lost due to a covered peril like fire, theft, or natural disasters. It also often includes liability coverage in case someone is injured on your property.

On the other hand, strata insurance covers the structure of the building and common areas in a condominium or strata property. This can include the roof, walls, floors, elevators, and shared amenities like swimming pools or gyms. Strata insurance also includes liability coverage for accidents that occur on the property’s common areas.

It’s important to note that while strata insurance covers the building itself, it may not cover the contents inside individual units. This is where contents insurance comes into play, as it protects your personal belongings inside your home.

Having both contents insurance and strata insurance can provide comprehensive coverage for your home and belongings. In the event of a disaster or accident, having both policies can help ensure that you are fully protected and can repair or replace any damaged items. It’s always a good idea to review your policies regularly and make sure you have the right coverage for your needs.

Get Strata Insurance Today

As a strata property owner, it is crucial to have the right insurance coverage to protect your investment. Strata insurance is designed specifically to insure multi-unit properties, such as apartments, condominiums, and townhouses. This type of insurance provides financial protection against unexpected events like natural disasters, theft, and damage to common areas. Without strata insurance, you could be left with significant financial losses if something goes wrong.

When it comes to getting strata insurance, it is highly recommended to work with a professional. They will help you navigate the complex process of selecting the right coverage and ensure that you are adequately protected. A professional can also help you identify potential risks and provide guidance on how to mitigate them. At HMD Insurance, our experienced team is dedicated to helping you find the best strata insurance for your needs. We take the time to understand your unique situation and provide personalised recommendations to ensure you are fully covered.

Don’t wait until it’s too late. Contact HMD Insurance today to get started on your strata insurance. Our experts will work closely with you to create a customised policy that meets your specific needs. With our help, you can rest assured that your strata property is protected from unexpected events. Don’t hesitate to reach out and take the first step towards securing your investment.

FAQ's

A: Strata insurance typically covers the building itself, common areas, and shared facilities in a strata-titled property in New South Wales. It may also include public liability insurance.

A: Strata insurance is necessary to protect the building and common areas against unexpected events like fire, storm damage, or accidents. It is a legal requirement in NSW for strata properties.

A: Generally, the body corporate or strata manager is responsible for arranging and maintaining strata insurance for the building. Individual unit owners are usually not required to take out separate building insurance.

A: Building insurance typically covers the physical structure of an individual unit or home, while strata insurance covers common property, shared spaces, and the building as a whole in a strata-titled property.

A: Yes, like any insurance policy, strata insurance may have limits on coverage amounts and exclusions for certain events or circumstances. It is important to review these details carefully before purchasing a policy.

A: You can consult with a strata management company, insurance broker, or directly contact insurance providers specialising in strata insurance, such as HMD Insurance.

A: When selecting a strata insurance policy, key factors to consider include the level of cover needed, any specific risks associated with the property, the insurance provider’s reputation, and the premium cost.